This section of the form is specially kept for the details of TDS from Form 15G/15H. This section of the form exclusively highlights the TDS deducted from your salary/pension income, TDS deducted by the banks on the interest generated from your investments. Part A of the form contains details of the Tax Deducted at Source (TDS) in Indian currency (INR). Brief details of the sections are provided below: The tax credits (to government tax authorities) appearing in Part A, A1, and B of this form are given on the basis of details furnished by the deductor/collector in the TDS/TCS statement filed by them. Get FREE Credit Report from Multiple Credit Bureausįorm 26AS for each financial assessment year is divided into multiple parts. Usually, the Form 26AS document is 3-4 pages long however it may be longer if the number of TDS/TCS-related on the form entries is greater in number. The following is a sample of what the first page looks like: For example: If your date of birth is 15 th April, 1985 then your password would be 15041985. The password is your DOB in DDMMYYY format. Step 7: To open the document you will be required to enter a password. Post selection, click on the button ‘View/Download’ Form 26AS download can also be done in PDF format. Step 6: Select the Assessment Year and the format (HTML/Text) in which you want to see Form 26AS.

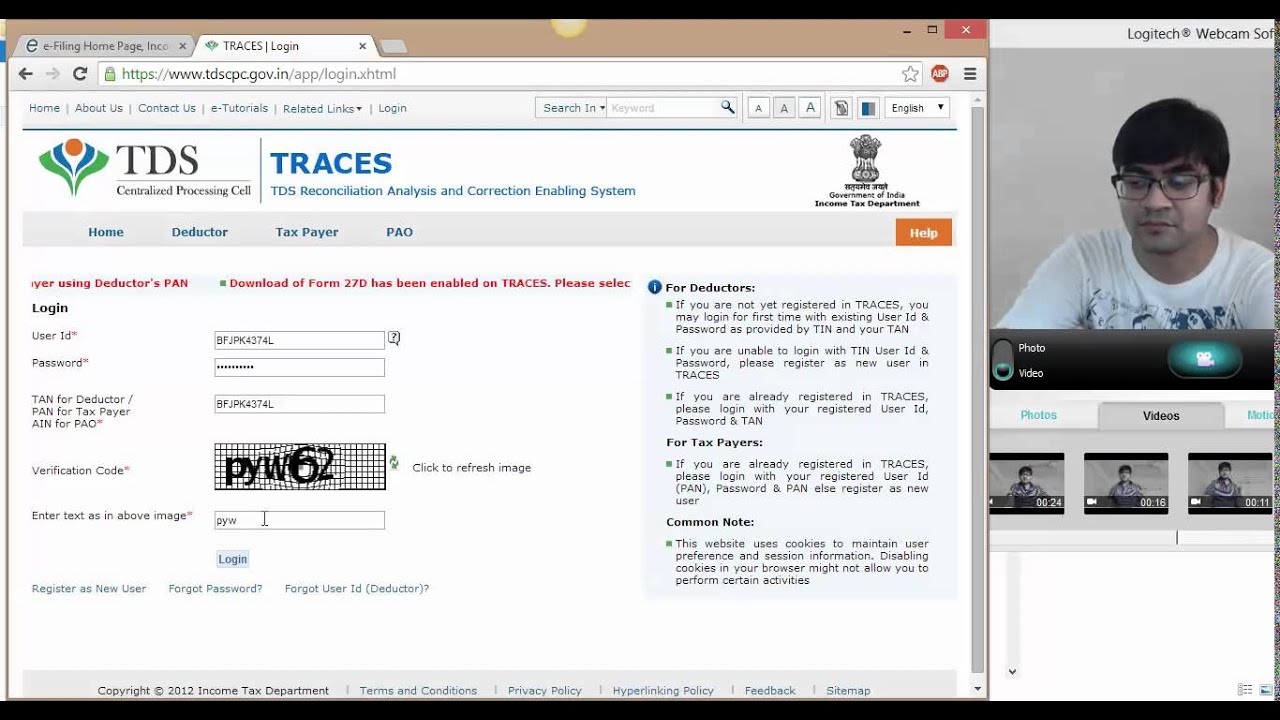

Step 5: Click on ‘View Tax Credit (Form 26AS)’ to view your Form 26AS Step 4: Agree to the usage and acceptance of Form 16 / Form 16A generated from TRACES and click on ‘Proceed’ Step 3: Click on ‘Confirm’ and you will be redirected to the TRACES website Go to ‘My Account’ and click on ‘View Form 26AS (Tax Credit)’ in the drop-down menu Step 2: After logging into your account, the following screen will appear.

Step 1: Login to Income Tax e-Filing Website to download Form 26AS You can download Form 26AS from TRACES website or using netbanking facility of authorized banks. Things to Verify in Your TDS Certificate with Form 26AS.

0 kommentar(er)

0 kommentar(er)